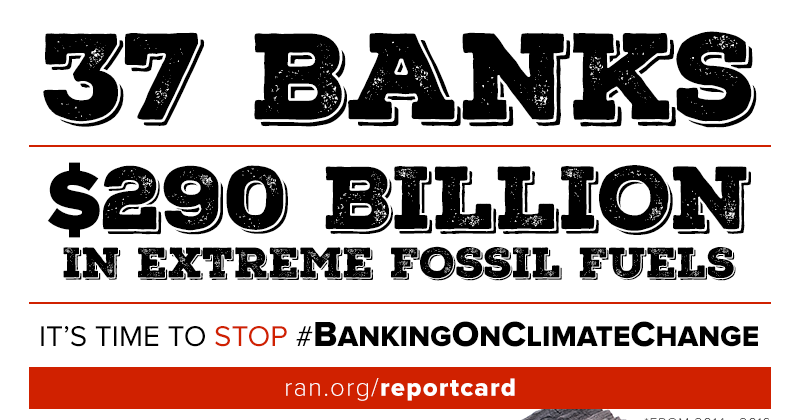

Banks continue to pour billions and billions into the most extreme fossil fuels — pushing us toward climate disaster and trampling on human rights along the way. From 2014 to 2016, big banks around the world sent $290 billion to the most environmentally destructive fossil fuels including coal, tar sands oil, Arctic and ultra-deep sea oil, and liquefied natural gas.

In Banking on Climate Change, the 8th annual fossil fuel finance report card, we analyzed bank policy and investments in extreme fossil fuels.

To keep the planet under 1.5 degrees of global warming and stop human rights violations, banks *must* stop financing extreme fossil fuels. Our planet just can’t take it.

See how your bank stacked up at the Banking on Climate Change website.

In Banking on Climate Change, you’ll find information crucial to the movement’s efforts to keep fossil fuels in the ground. You can arm yourself with the evidence you need to hold banks accountable for their short-sighted investment in coal, extreme oil, and extreme gas.

Here are some key findings:

- After the Paris Accord was signed in 2015, bank investment in extreme fossil fuels declined — but JPMorgan Chase and 11 other banks bucked the trend and increased financing of extreme fossil fuels in 2016.

- Tar sands expansion faces unified opposition from 122 Indigenous tribes and First Nations in the Treaty Alliance Against Tar Sands Expansion. And yet banks poured $47.78 billion into tar sands oil in 2014-2016.

- Today and tomorrow’s energy jobs are in renewables — *not* coal. And yet, banks are increasing their investment in coal power.

Find out more, explore the data, and tell your bank to stop banking on climate change and human rights violations.