This Understory was penned in collaboration with Gaurav Madan from Friends of the Earth USA

This week, RAN and international civil society groups are calling for a Week of Action on the forest fires in Indonesia and the Amazon. Fires that are wrecking Indigenous lands and turbocharging climate change and the extinction crisis.

Moreover, this year, the fires are likely to compound the dual public health and economic crises posed by COVID-19, putting extra strain on healthcare systems and economies reeling from the impact of the pandemic. COVID has already been affecting Indigenous and frontline communities disproportionately, and the fires are now exacerbating their dire situation.

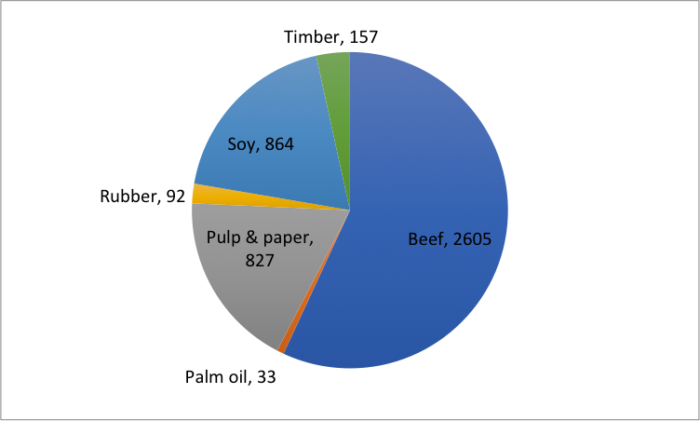

Tropical forests do not burn by themselves and what we’re seeing in Brazil and Indonesia are not “wildfires”. They are intentionally ignited to open up new areas of land for Big Agribusiness: in Brazil it’s driven by beef and soy, and in Indonesia its palm oil and pulp and paper. Though it’s illegal, companies use fire as it’s the cheapest way to clear new areas of land. And these companies, directly or indirectly linked to the fires, are receiving vast sums of credit and investment from banks and investment firms, many of whom claim to be committed to sustainability.

This is why this week, we’re highlighting the role of four key financial institutions: BlackRock, Santander, Mitsubishi UFJ Financial (MUFG) and Bank Negara Indonesia (BNI). Using a new financial transparency tool just launched by RAN and our partners, we’re able to pinpoint exactly which banks and investors are fueling rainforest destruction and the fires, and with how much money. The verdict? These four investors and banks are huge players in palm oil, pulp & paper, beef, and soy industries that are destroying forests with fires.

MUFG — money funneled to deforestation-risk activities since 2016: $3.2 Billion

The world’s fifth largest bank by assets is Japanese mega bank Mitsubishi UFJ Financial Group (MUFG), and it’s actually the largest financier of the palm oil sector based outside of Southeast Asia. MUFG has been funding some of the largest palm oil & pulp and paper companies in the world, like Sinar Mas Group, that are destroying rainforests and carbon-rich peatlands in Indonesia that are incredibly important for climate stability. The destruction of peat has been the primary cause of Indonesia’s fires and the main reason these fires emitted even more carbon than the fires in the Amazon!

Unfortunately, MUFG’s public policies say nothing about fires and haze, and their Indonesian subsidiary called Bank Danamon isn’t even required to follow the bank’s policies. Fortunately for us activists, MUFG has a large presence in the US: they own West Coast-based Union Bank and they’re the largest shareholder in Morgan Stanley. So we can pressure them on our home turf.

BlackRock — money invested in deforestation-risk activities in 2020: $1.3 Billion

As the largest asset manager in the world, and largest investor in the companies responsible for the climate crisis, BlackRock has a big problem. Despite a recent commitment to center climate in its investment strategy, BlackRock lacks a coherent and comprehensive policy addressing deforestation, human rights, and the rights of Indigenous Peoples and local communities on the frontlines of the climate crisis, while having massive investments in deforestation-risk companies. Even worse, since 2010, BlackRock has shamelessly voted against every single shareholder resolution calling for action on deforestation. Here’s a snapshot of BlackRock’s deforestation problem:

- BlackRock is among the top three shareholders in 25 of the world’s largest publicly listed deforestation-risk companies.

- BlackRock is a major investor in the world’s largest meat-packer called JBS, to the tune of nearly $140 million USD, despite repeated evidence that JBS is linked to the Amazon fires and even recent evidence that cattle illegally grazed in protected areas of Brazil’s Amazon rainforest are in its supply chain.

- BlackRock has $250 billion invested in consumer goods companies that committed to end deforestation in their supply chains by 2020 — and have failed.

Santander — money funneled to deforestation-risk activities since 2016: $5 Billion

Santander has branches around the US, but is headquartered in Spain, and directs a lot of financing to companies in Brazil. They’ve made various no deforestation pledges, but they’re actually heavily exposed to rainforest destruction, especially in the Amazon.

Santander is a member of the Banking Environment Initiative and a signatory to the Soft Commodities Compact since 2012. By signing the Compact, Santander promised to work with Consumer Goods Forum (CGF) companies to achieve “zero net deforestation” in their soy, palm oil, beef and pulp, paper and timber supply chains by 2020. Santander also committed to ensure that their clients and investees “whose operations include significant production or processing of palm oil, timber products or soy in markets at high risk of tropical deforestation can verify that these operations are consistent with zero net deforestation by 2020.” Noticeably missing from this list is the financing of beef.

Greenwashing aside, Santander is in fact one of the largest financiers of the beef sector in Brazil, including controversial companies like Marfrig and JBS, despite this sector’s clear links to Amazon deforestation and clearing of forested land with fires.

Bank Negara Indonesia — money funneled to deforestation-risk activities since 2016: $2.4 Billion

BNI is one of the largest banks in Indonesia, and presents itself as a country leader on sustainability. But it has no published policy that prohibits the use of fire or developing plantations on peatlands, which are turning parts of Indonesia into a tinderbox.

BNI’s client list includes several companies who had their plantations sealed by the Indonesian government in 2019 because of fires in their plantation areas. BNI’s most prominent client is Sinar Mas Group (mentioned earlier), which is one of the largest pulp & paper and palm oil companies in the world and has the largest forest fire footprint of any corporate group in Indonesia. BNI has financed both to the tune of over $1.2 Billion since 2016. According to Greenpeace, this group’s pulp and paper arm, Asia Pulp & Paper (APP), and its subsidiaries, partners and suppliers had a total burned area of over 250,000 ha in Indonesia between 2015 and 2018, and the company is still clearing more land for plantations, while embroiled in widespread land conflicts. This has a humongous climate impact too, because much of their plantations are developed by draining and degrading deep peat – soils where organic matter accumulated over thousands of years and as a result stores an enormous amount of carbon. This has to stop.

This month and going forward, RAN will be ramping up the pressure on these banks and investors, exposing how their reckless financing is endangering our future and the future of our planet. Help us keep the pressure on these companies by signing this petition!