This post is by Yann Louvel, BankTrack Climate and Energy Campaign Coordinator.

This post is by Yann Louvel, BankTrack Climate and Energy Campaign Coordinator.

Earlier this month, Bank of America participated in the 2014 Investor Summit on Climate Risk as the “convening sponsor” of the event. While there was a lot of talk about the urgency of the problem of tackling climate change, there were a few things the bank didn’t talk about. For starters, their role in financing the coal industry.

The 2014 Investor Summit on Climate Risk took place at the United Nations in New York on January 14th. Among the speakers was Lisa Carnoy, Head of Global Capital Markets for Bank of America Merrill Lynch, whose bio tells us that she “leads 700 Capital Markets professionals across Equity Capital Markets, Debt Capital Markets, Leveraged Finance and Origination of Corporate Derivatives and FX across the Americas, Europe, Asia and the Emerging Markets.”

If the bank’s finance for fossil fuels wasn’t mentioned at all, what do you think Carnoy did talk about in her speech? You may be pleased to hear that she conveyed the great imperative felt by the banking sector on climate change. Bank of America’s approach to the issue would be “like a hockey team: we’re fierce, we’re fast, and we feel the urgency.” What’s more, the banking sector as a whole was coming together to “put aside its natural competitiveness,” because “this is incredibly important, the time is now, and we need to work together.”

Great! So how had this fierce, fast hockey team come together to tackle climate change? The one initiative Carnoy presented was the Green Bonds Principles, a set of voluntary guidelines for how banks can develop and issue bonds to support green industries, which she implored investors to get behind.

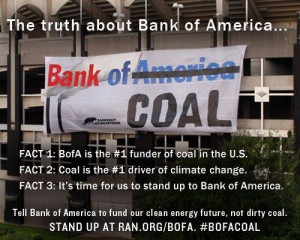

While we support any efforts to scale up finance for genuine alternatives to fossil fuels, Bank of America’s backing for green bonds is dwarfed by the activities that Carnoy did not talk about. These are the activities that we have been exploring in our most recent reports: its finance for the coal sector. Bank of America was ranked the number three “climate killer bank” worldwide in the BankTrack network’s 2011 Bankrolling Climate Change report, which covered investments in 70 of the largest coal companies between 2005 and 2011. And in BankTrack’s more recent Banking on Coal report, Bank of America again ranked world number three, this time in its finance for coal mining, based on an analysis of finance for 70 coal mining companies worldwide.

Among the deals Carnoy did not talk about are some (not remotely green) bonds issued by her Capital Markets team over the last two years, which helped to raise over $1 billion for Alpha Natural Resources and Arch Coal. These companies are pure-play US coal miners, and are being targeted by campaigners for their involvement in destructive mountaintop removal coal mining in Appalachia. These bonds are toxic for our climate as well as for the investors who buy them, spreading climate risk through the financial markets in the form of potential future “stranded assets.”

While Bank of America is asking investors to back the Green Bonds Principles, it is investors who should be asking Bank of America to stop feeding them with these financially risky climate killer bonds. And now that Bank of America feels the “urgency” and “imperative” of tackling climate change, it would do well to stop financing climate change through issuing bonds for coal mining.

It is time for banks to come together, put aside their natural competitiveness, and agree to stop financing coal. Because this is incredibly important. The time is now.