We all know that keeping the world’s remaining tropical forests standing is essential for sustaining a healthy and habitable planet, but major institutional investors and banks still do not seem to have digested the news.

A new Forests & Finance Dossier, Every Investor Has A Responsibility, lays out the human rights, climate and biodiversity risks investors and financiers face—and the adverse impacts they must cut ties with—to successfully combat deforestation and associated human rights abuses in the tropical forest sector.

The Dossier compiles evidence of numerous harmful activities of 8 companies: Felda Global Ventures, IOI, Indofood Sukses Makmur, Wilmar, Asia Pulp and Paper, Oji Holdings, Marubeni, and Itochu. Some of their operations and supply chains have involved child and forced labor; forest and peat fires that caused toxic regional haze; illegal logging; plantation expansion and forest conversion; land conflicts with local communities; human rights violations; and destruction of habitat for critically endangered species.

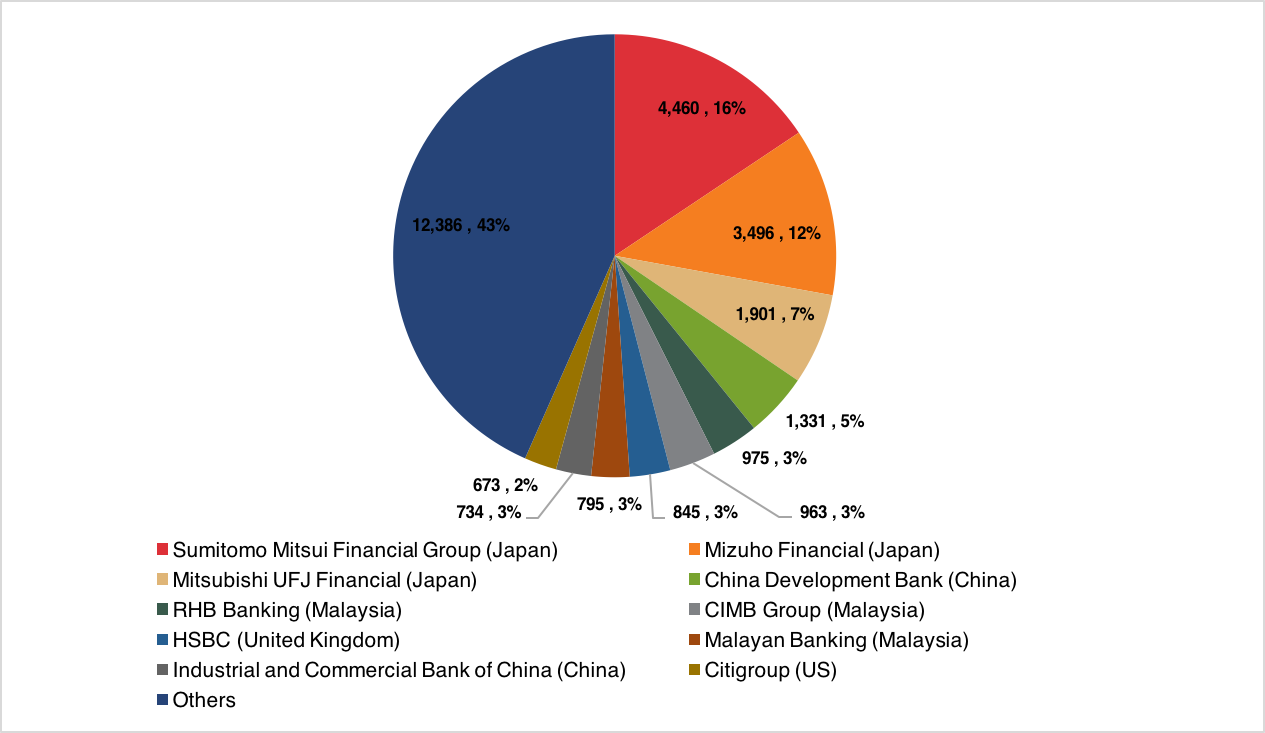

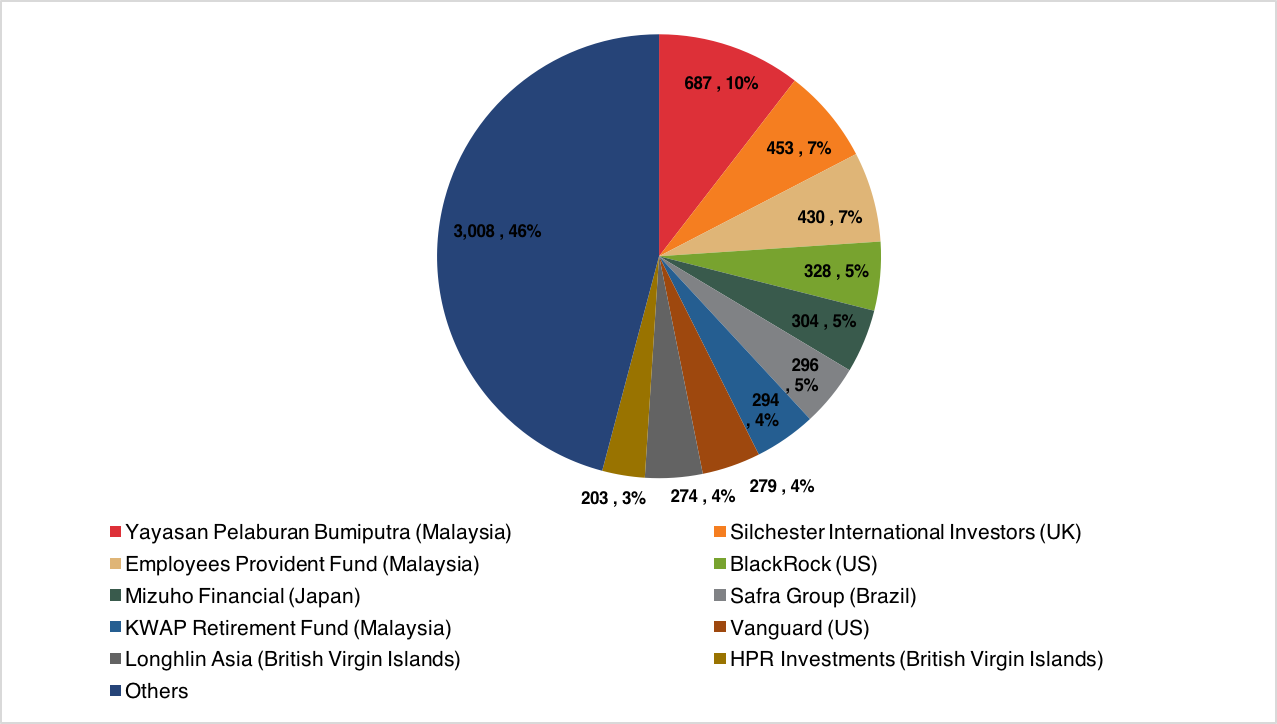

Banks and investors share a responsibility for contributing to these adverse impacts, which were enabled through a combined 28.56 billion USD in loans and underwriting since 2010 and at least an additional 6.56 billion USD in share- and bondholdings in the 8 companies (at their group level), as of the most recent filing date.1

Total loans & underwriting provided to the 8 forest-risk sector companies, by financial institution

(2010-Feb 2017, million USD, forest-sector adjusted*)

Total: 28.56 billion USD

Total bond- and shareholdings in the 8 forest-risk sector companies, by financial institution

(2010-Feb 2017 most recent filing date, million USD, forest-sector adjusted*)

Total: 6.56 billion USD

Source: forestsandfinance.org ‘Explore the data’, 2016–2017 data available online soon

Some of the largest investors with holdings in these companies include well-known firms such as US based Vanguard and Blackrock and Japan’s Government Pension Investment Fund. Three Japanese mega-banks – Sumitomo Mitsui Financial Group, Mizuho Financial and Mitsubishi UFJ Financial – figure prominently among lenders to these 8 companies as well.

The findings raise serious concerns about continuing gaps in the financial sector’s social and environmental safeguard policies and related due diligence procedures for forest-risk sectors including palm oil, tropical timber, pulp and paper, and rubber.

1.The amount representing bond- and shareholdings does not include those held by some pension funds, including Japan’s Government Investment Pension Fund, due to limitations of available data. For more information, see forestsandfinance.org.

*Companies with diversified interests had identified financial totals reduced to more accurately capture the proportion of financing that can be reasonably attributed to the forest-risk sector production or primary processing operations of the selected company. Where available financial information did not specify the purpose of investment or receiving division within the parent company group, reduction factors were individually calculated by comparing a company’s forestry assets relative to its parent group total assets.

For further information on this briefing please contact Adelaide Glover, Rainforest Action Network, adelaide AT ran.org

Read or download the report:

Every Investor Has A Responsibility [English]

Every Investor Has A Responsibility [Japanese]