The latest annual report from the Forests & Finance Coalition reveals a wide gulf between big banks’ environmental pledges and their business-as-usual financing of companies that pose grave risks to tropical forests and frontline communities.

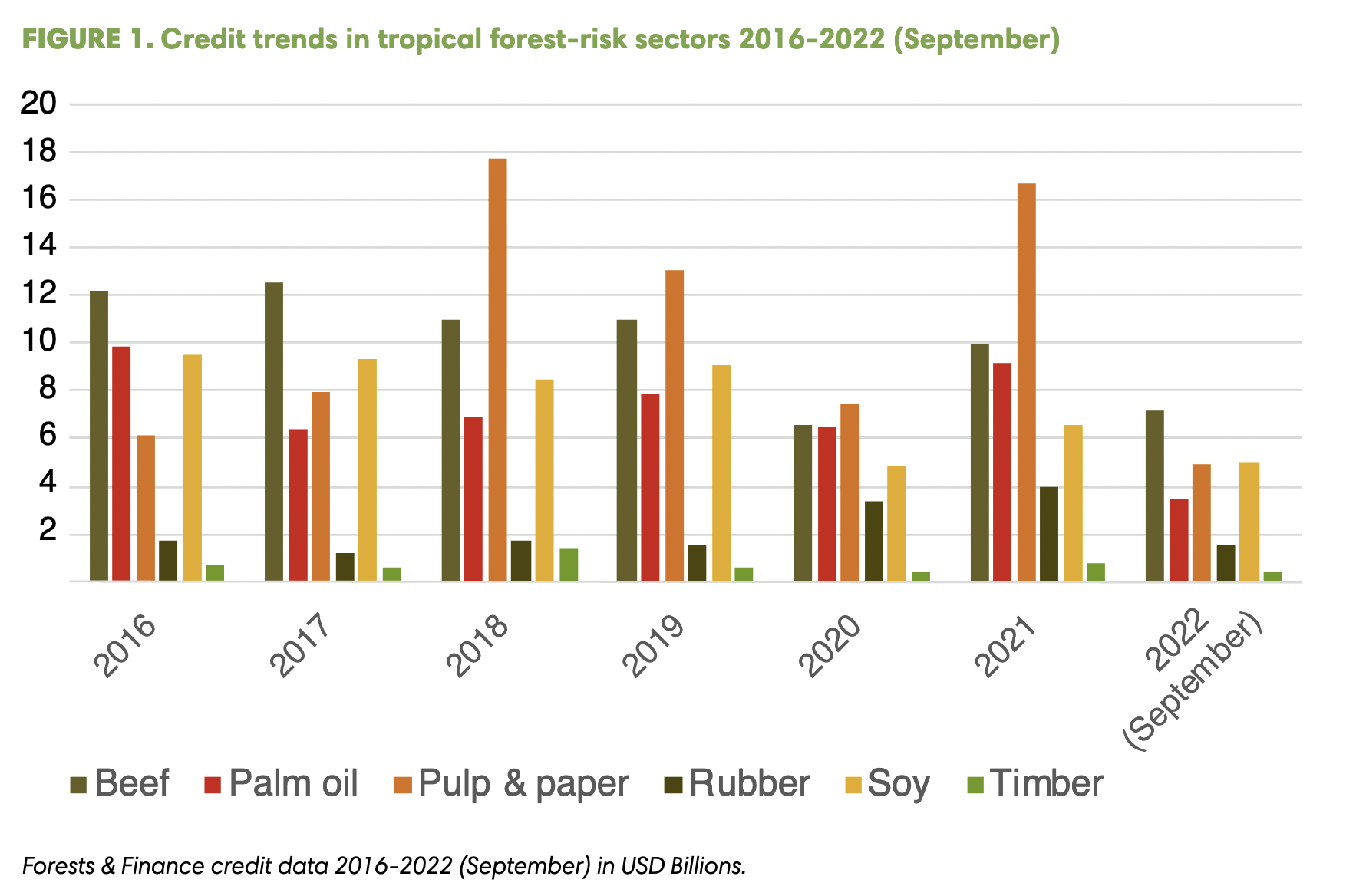

Since the 2015 Paris Agreement, banks have pumped $267 billion into agriculture, forestry and other land use companies that operate in the world’s three largest tropical forest regions. That’s enough money to fill 25 railroad freight cars with $100 bills — a quarter-mile long train.

Between 2020 and 2021, bank financing to so-called “forest-risk” commodity sectors increased almost twofold. Some of the major culprits named in this report are the usual suspects: JP Morgan Chase, Bank of America, Citibank and investment giants such as Blackrock and Vanguard.

Bad Money After Bad

Financing of forest-risk commodities proceeds against the backdrop of climate change and rapid biodiversity loss, including climate shocks and weather events increasing in their frequency and severity globally. Addressing these pressing issues requires rapid decarbonization and the protection and restoration of natural ecosystems — chief among them the planet’s tropical forests.

“It is now well established that the twin crises of climate change and biodiversity loss pose a generational, planetary scale threat and yet, the world’s financial institutions are actually increasing their lending to the very industries driving humanity to the brink.” — Tom Picken, Forests & Finance Campaign Director

Weak Policies

Despite “net-zero” pledges from financial institutions at COP26 Glasgow last year, it remains unclear how and when the financial sector will decarbonize. Responsible lending policies for the agriculture, forestry and land-use sectors — which account for nearly a quarter of global carbon emissions — remain dangerously inadequate across financial institutions.

Our latest assessment shows that the majority of the world’s largest banks and investors lack Environmental, Social and Governance (ESG) policies to prevent deforestation, peat degradation and fires, or to uphold the human rights of communities who live in and rely on forests, including Indigenous peoples.

Read More

For more in-depth information, including best-practice ESG policy recommendations for the financial sector, read the full report by the Forests & Finance Coalition. Also use their searchable transparency platform to find current data on the lending practices of financial institutions in forest-risk commodity sectors.