New Report: Despite ‘Net Zero’ Rhetoric, World’s Biggest Banks Continued to Pour Billions into Fossil Fuel Expansion in 2021

Annual Banking on Climate Chaos report follows the money and details massive bank support for the world’s worst climate-destroying corporations. San Francisco – Released today, the 13th annual Banking on…

[OCT 2021 Update] Who’s banking the Coastal GasLink pipeline?

The short version In 2020, 27 banks from around the world took part in a CAD $6.8 billion (USD $4.8 billion) project finance loan to fund the construction of the…

These Chase Executives are Profiting Off the Climate Crisis

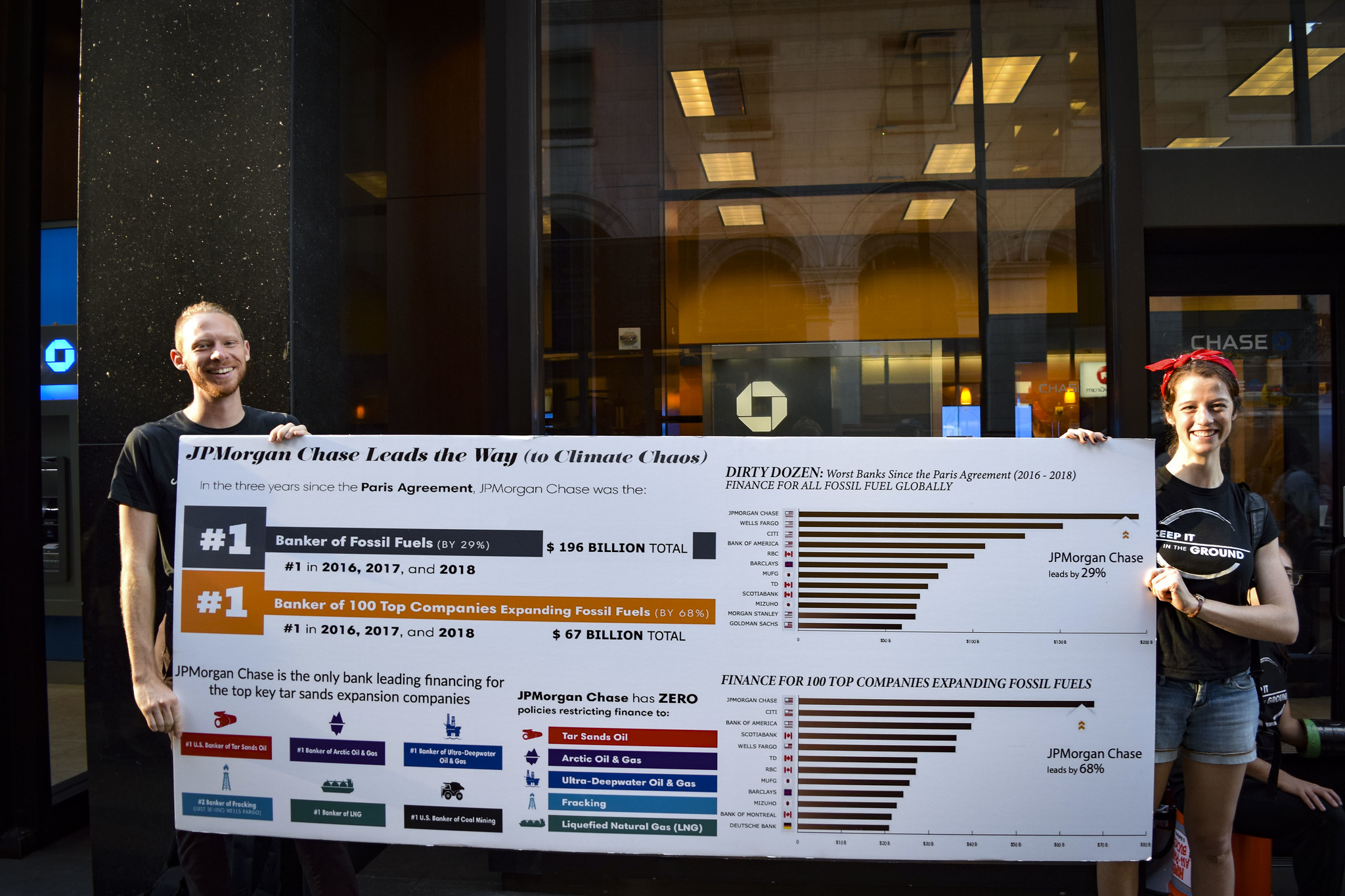

In March, we exposed the 60 banks that have poured $3.8 trillion into fossil fuel financing: Can you guess who’s ranked the world’s WORST funder of fossil fuels? JPMorgan Chase…

With Jamie Dimon’s annual letter, JPMorgan Chase continues to fail on climate

New York, NY — Today, JPMorgan Chase (JPMC) CEO Jamie Dimon released his influential annual letter to shareholders. In Dimon’s longest letter so far, a major focus is on how…

The data is in: Chase, Citi, and MUFG are hurling us all towards climate catastrophe

Our annual flagship report, Banking on Climate Chaos, has revealed that JPMorgan Chase is once again the top funder of fossil fuels since Paris, followed by Citi. MUFG earns a dishonorable mention for its funding of poisonous pipelines. Fortunately for them, we have a plan–and we’ll make sure our voices are heard.

Case Study: EMBA Hunutlu Coal Plant

This blog was originally published as a case study in “Banking on Climate Chaos: Fossil Fuel Finance Report 2021” — a report by Rainforest Action Network, BankTrack, Indigenous Environmental Network,…

Case Study Compilation: Oil and Gas Projects

This blog was originally published as case studies in “Banking on Climate Chaos: Fossil Fuel Finance Report 2021” — a report by Rainforest Action Network, BankTrack, Indigenous Environmental Network, Oil…