A Guest blog-post by Yann Louvel, BankTrack‘s Climate and Energy Campaign Coordinator

A Guest blog-post by Yann Louvel, BankTrack‘s Climate and Energy Campaign Coordinator

This week, Bloomberg published the results of its third annual ranking of the “world’s greenest banks”: Citi was ranked first, followed by Santander and JPMorgan. The study assesses banks based on their lending to clean-energy projects and reduction in their own power consumption and carbon footprints. However, banks’ support for dirty energy, such as fossil fuel and nuclear power, is notably absent from Bloomberg’s methodology. When the value of banks’ finance for fossil fuels so often dwarfs their investments in renewables, Bloomberg’s data does not even tell half of the story.

Measuring the Good, Ignoring the Bad

One question mark over Bloomberg’s ranking is its definition of “clean energy”, and in particular its inclusion of hydropower (including large environmentally and socially destructive dam projects) and biomass/biofuels in this definition.

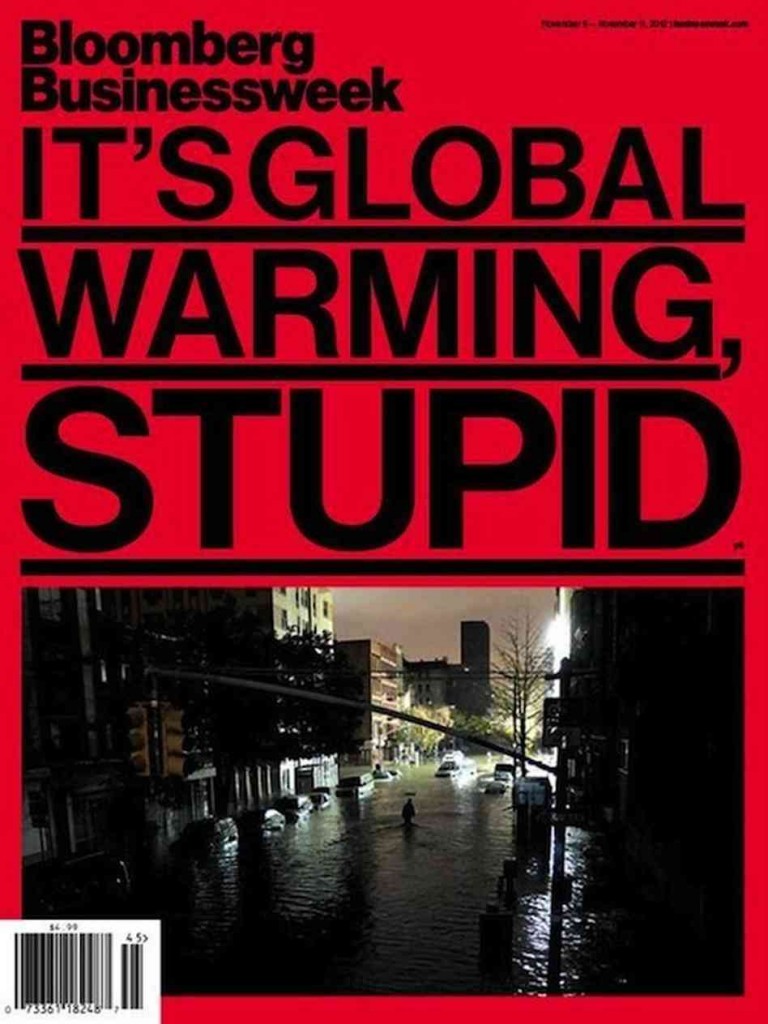

But the fundamental problem with its approach lies in the complete omission of banks’ investments in fossil fuels and nuclear energy. While banks’ growing investments in green energy are to be welcomed, it is even more crucial that investments in fossil fuels drop drastically in the coming years if we are to have a chance of avoiding catastrophic global warming. The ratio of green to “brown” investments would provide a meaningful study on the level of “greenness” of a bank, but looking at clean investments alone makes this little more than a PR exercise for the banking sector.

To give a concrete example of this problem, BankTrack, together with urgewald, Groundwork and Earthlife Africa, released the “Bankrolling Climate Change” report in Durban in 2011. The report is an investigation into the coal investments of the world’s leading banks. We looked at the funding of 93 international banks in 71 coal companies between 2005 and 2011 to identify the “top 20 climate killer banks” in the world. The results show a significant overlap between Bloomberg’s “world’s greenest banks” and the top 20 climate killer banks. In fact, seven of Bloomberg’s top ten appear in the “Climate Killer” list.

| Bloomberg’s “World’s Greenest Banks” | ||

| Name | Bloomberg rating (2012) | Climate Killer Banks rating (2011) |

| Citigroup | 1 | 2 |

| Santander | 2 | – |

| JP Morgan Chase | 3 | 1 |

| Mitsubishi UFJ Finance Group | 4 | 17 |

| Credit Suisse Group | 5 | 9 |

| Goldman Sachs | 6 | 11 |

| Deutsche Bank | 7 | 6 |

| Mizuho Financial Group | 8 | – |

| Lloyds Banking Group | 9 | – |

| Barclays | 10 | 5 |

Citi, which tops Bloomberg’s list, was rated the number two climate killer bank, and JPMorgan, our number one climate killer bank, is Bloomberg’s number three. Citi’s investments in the coal industry grew by 40% between 2005 and 2010 as the bank poured more than €13 billion into the coal industry. Citi’s profile on the BankTrack website links the bank to the controversial Keystone XL tar sands pipeline, as well as mountaintop removal coal mining and the controversial Alpha Coal project in Australia, expected to directly and negatively impact the Great Barrier Reef. This makes the “Greenest Bank in the World” tag a little hard to swallow.

Environmental Direct-Impact, Back to Sustainability Pre-History

Another disturbing aspect of Bloomberg’s methodology is that “reductions in air emissions and water use and gains in energy efficiency” account for a full 30 percent of the score. These are banks’ “direct” impacts, e.g. their own use of energy for electricity and office heating. If this approach would have been understandable in the 1990s, it seems extremely dated in 2013, to say the least.

Numerous studies, particularly from NGOs including many from BankTrack members and partners in the past few years, have clearly demonstrated that banks’ primary environmental impacts are result from their core activities – their lending and investments – rather than through their “direct” impacts. While the sustainability debate in the banking sector started ten or twenty years ago with these direct impacts, the trend since then has been towards looking at the issues that matter: the impacts of banks’ finance. Methodologies for measuring these ‘financed emissions’ already exist, and BankTrack has long called on banks to report on these impacts systematically.

Management and reduction of direct impacts should be considered a ‘hygiene factor’ for banks, rather than a core issue. When Bloomberg reports that JPMorgan, which invested more than €16 billion in the coal industry between 2005 and 2011, “revamped its Park Avenue headquarters in New York, where energy-saving lights now dim automatically and a 54,000-gallon basement tank collects rain for flushing toilets and watering plants”, one has to wonder if it is looking down its telescope backwards.

Stop The Greenwashing

By avoiding mention of fossil fuels and nuclear energy, and by giving undue weight to banks’ direct impacts, Bloomberg’s “greenest banks” methodology is fundamentally, and it would seem deliberately, flawed. (BankTrack and partners Rainforest Action Network and urgewald already raised these concerns in a letter to Bloomberg last year).

The results of this study will now be used by the “world’s greenest banks” in their marketing and public relations material – a generous but undeserved gift to banks which are ploughing billions into environmentally destructive projects. This is a shame when there remain plenty of opportunities for Bloomberg, banks, analysts and other stakeholders to examine bank’s investments in fossil fuels, nuclear power, and their financed emissions. BankTrack will continue to denounce such greenwashing exercises in the coming months and years.