As 500 climate activists set up camp at RBS Global Headquarters in Edinburgh last week, the bank tried and failed to play the victim. Despite the bank’s assertions to the press, we showed that the bank is not a top funder of renewable energy (according to Bloomberg), and never offered to meet with protest leaders (according to protest leaders).

This week, as campers emerged from their tent village to lay non-violent siege to RBS facilities throughout Edinburgh, the bank released “new figures” to re-assert its green credentials. Yesterday, an RBS Spokesperson told the Guardian:

“Since January 2006, we have lent more money directly to wind power projects than to any other type of energy project and have been the leading UK financier of this sector over the last 10 years… We are one of the biggest lenders in the UK to renewable projects. Between 2004 and 2008 RBS lent more to renewable power projects than any other commercial bank globally.” [emphasis added]

The bank’s carefully crafted statement is technically accurate but intentionally misleading. First RBS relies on outdated pre-recession figures. Second, RBS’s new figures isolate “project finance,” a relatively small segment of its overall business.*

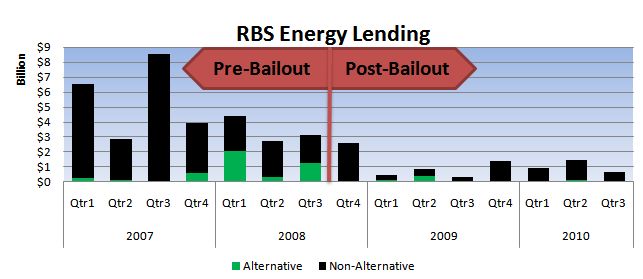

A careful look at financial transactions compiled by Bloomberg shows the inconvenient truth that RBS is trying to hide: Since UK taxpayers took over the bank in 2008, the bank’s alternative energy lending has declined by nearly 86% ($640 million since the bailout vs. $4.5 billion in the same period prior). The graph below shows the trend in alternative vs. conventional energy lending (project finance and general lending) underwritten by RBS since 2007.

Globally, RBS’ rank in terms of lending to alternative energy projects fell from 1st place in 2004-2008 as cited in yesterday’s “new figures” to 39th in the period since.

The point here is not to split hairs over language and data points. The point is that RBS needs to walk the talk. The bank says that “Just as society as a whole has to make a transition to renewable energy sources so will banks like RBS,” so let’s either see more of that (our preference) or hear less of it.

*Project Finance refers to a specific type of loan secured by large industrial projects (like wind farms and pipelines). By contrast, general “corporate lending” is essentially a cash transaction secured by a borrower’s assets and generally not tied to a specific project. Project Finance comprises only a fraction of RBS’ overall lending. General corporate lending is the bank’s bread and butter.