With a flurry of commitments in the weeks leading up to the Glasgow climate summit, Mark Carney’s Net-Zero Banking Alliance (NZBA) now counts among its members the vast majority of the world’s biggest fossil banks — including the 13 top fossil fuel funding banks in the world since Paris, and 21 of the top 23. Altogether, the 39 NZBA signatories that are among the world’s 60 largest banks account for US $3.1 trillion in fossil fuel financing from 2016-2020, 82% of total financing.

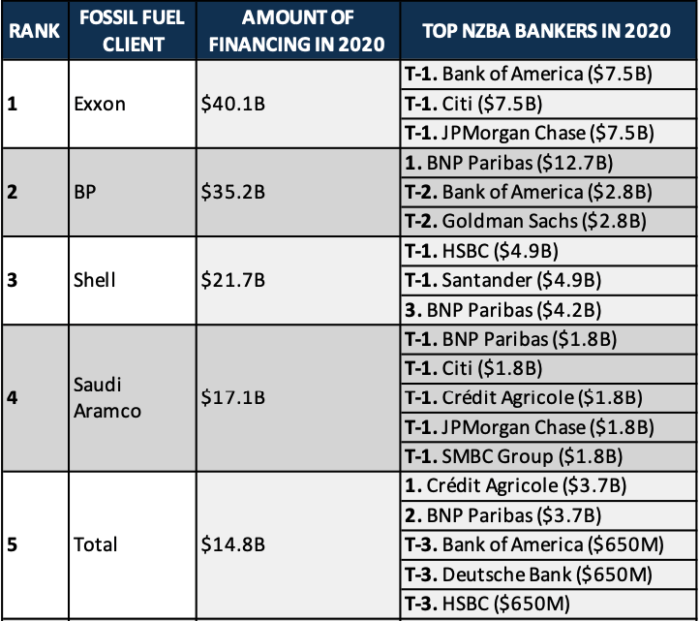

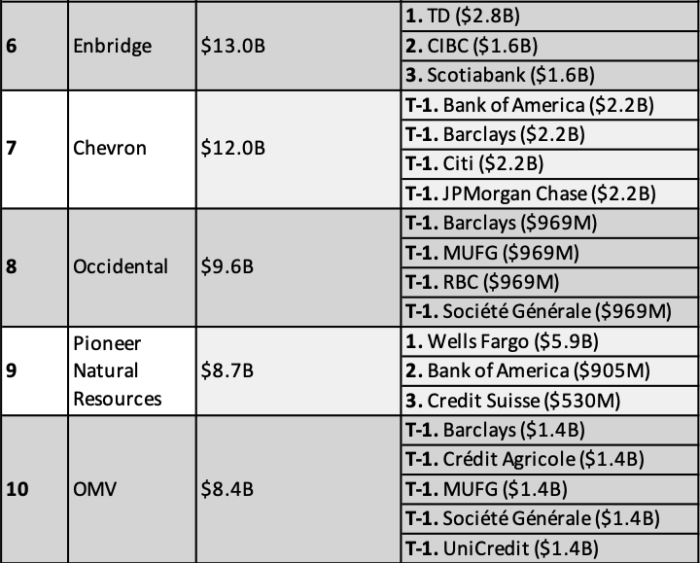

We’ve run the numbers on NZBA banks’ top fossil fuel clients in 2020 — the last year for which we have full data — and the results show just how big a challenge the NZBA faces. (All figures drawn from Banking on Climate Chaos 2021.)

In 2020, 39 NZBA banks provided a total of $575 billion in lending and underwriting to the fossil fuel industry. The top ten clients were:

As a coalition of environmental groups wrote to Carney last month, “A global consensus – driven by the International Energy Agency and cited by the UN Secretary General – is solidifying: to meet the goals of the Paris Climate agreement, no more coal, oil, or gas expansion are permitted.” But each and every one of these top fossil clients is among the world’s biggest oil and gas expansion companies.

Top client Exxon is a case in point. As Oil Change International has documented, not only is it planning massive expansion of oil and gas extraction — it is also continuing exploring for new reserves; has no commitment to decrease production by 2030, and has no commitment to end production in line with 1.5°C.

NZBA banks face a choice: either they rule out support for companies expanding fossil fuels, or their net-zero commitments are greenwash.

But of the NZBA’s biggest fossil bank signatories, none of them has a policy prohibiting finance for oil and gas expansion companies.

And the NZBA’s guidelines do not require its signatory banks to adopt such a policy: it is a big tent, with a low bar, as RAN and the Sierra Club said at the initiative’s launch in April. New analysis from Reclaim Finance underlines the weakness of the NZBA’s requirements (and those of its fellow Glasgow Finance Alliance for Net Zero initiatives). We don’t agree with Jamie Dimon on much, but in this case, it looks like the JPMorgan Chase CEO is on to something: “Mr. Dimon privately criticized Mr. Carney’s effort as overly vague,” the Wall Street Journal reported last week.

The NZBA has a $40 billion Exxon problem, and no clear plan to fix it.

Top NZBA fossil banks — including Citi, Wells Fargo, and Bank of America — are in the process of choosing scenarios, targets and client criteria as they implement their net-zero commitments. In the face of the clear consensus on the need to end fossil expansion to limit global warming to 1.5°C, each of them faces a clear choice: either they rule out fossil expansion, or their net-zero commitment is greenwash. Their policies now implicate Mark Carney’s NZBA as well.

Early signs aren’t encouraging: JPMorgan Chase, the #1 fossil bank in the world and a recent NZBA signatory, this year published 2030 interim targets that appear to meet the on-paper guidelines of the NZBA — and are fully compatible with massive expansion of fossil fuels.

One NZBA signatory offers a model for what its peers should do: La Banque Postale, the 11th-largest bank in Europe, last month published a groundbreaking policy that rules out financing for companies expanding oil and gas, and commits to exit oil and gas by 2030.

The NZBA has signed up most of the world’s most important fossil banks. It’s crucial that they truly align with 1.5°C, and the initiative is under threat if they don’t. NZBA signatories should emulate La Banque Postale, and the NZBA should strengthen its criteria to ensure that they do so.